The power of a provider agnostic portal

Empowering Growth with a Provider Agnostic Portal for your data management needs.

Every businesses with a ‘digital presence’ like a webshop generate vast amounts of data on a daily basis. This treasure trove of information, when harnessed effectively, can provide valuable insights that drive business growth. Payment data analytics is the key to unlocking some of these insights, ensuring a deep understanding of customer behavior, financial performance, and market trends. In this article, we will explore the power of payment data analytics and how a provider agnostic portal – like unifinu- can be a game-changer for businesses looking to fulfill this potential.

The Power of Payment Data Analytics

Payment data analytics involves the collection, analysis, and interpretation of payment related information to make informed business decisions. Some of the key benefits it offers are:

Customer Insights: Payment data analytics can reveal valuable insights into customer preferences, spending patterns, and purchasing behaviors. This information allows businesses to tailor their products and services to meet customer needs effectively.

Fraud Detection: It helps in identifying unusual or suspicious transactions, reducing the risk of fraud and chargebacks. By leveraging historical payment data, businesses can implement proactive fraud prevention measures.

Financial Forecasting: Payment data analytics enables accurate financial forecasting and budgeting. Businesses can use historical payment data to project revenue, track cash flow, and make informed financial decisions.

Market Trends: Analyzing payment data from various sources can uncover market trends and competitive intelligence. Businesses can use this information to stay ahead of the curve and adapt to changing market dynamics.

Operational Efficiency: By analyzing payment data, businesses can identify bottlenecks and inefficiencies in their payment processes. This information can lead to streamlined operations and cost savings. Especially when services like API reporting becomes available.

Personalization: Payment data analytics can help businesses deliver personalized marketing campaigns and offers to their customers, improving customer engagement and loyalty. For example a newly introduced payment method that is getting traction in a specific region. This information can for example be used to improve the checkout by changing the order of payment methods.

Challenges with Payment Data Analytics

While the potential benefits of payment data analytics are clear, businesses often face challenges in applying this power effectively:

Data Silos: Payment data may be spread across different payment providers, making it challenging to consolidate and analyze.

Data Integration: Integrating data from multiple payment providers can be complex, especially when each provider has its own data formats and API’s.

Provider Lock-In: Businesses may feel tied to a specific payment provider, limiting their flexibility to switch providers or leverage multiple options.

Data Security: Handling sensitive payment data requires robust security measures to prevent data breaches and maintain compliance with data protection regulations.

How a Provider Agnostic Portal Empowers Businesses

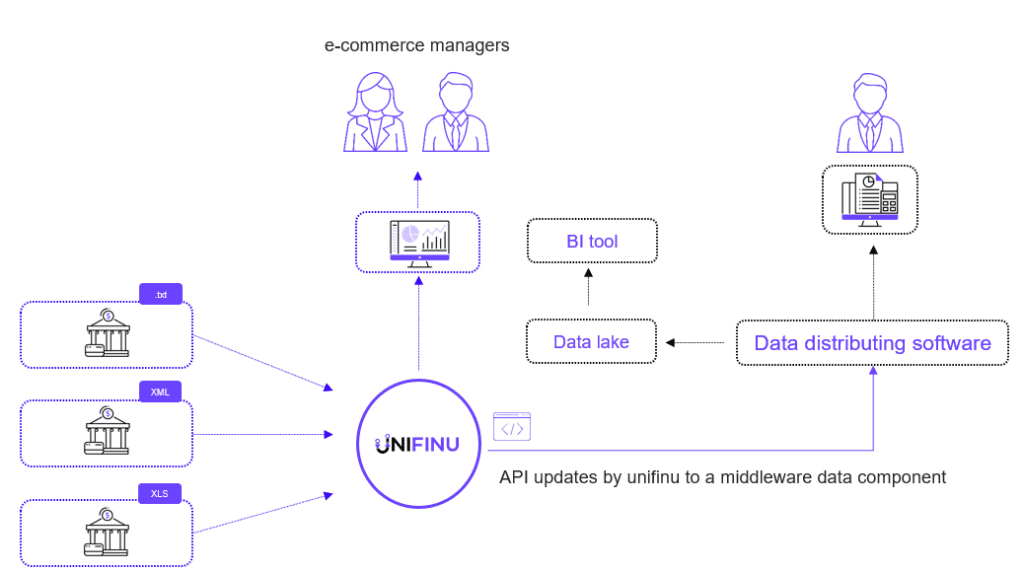

A provider agnostic portal is a centralized platform that connects to multiple payment providers, offering businesses a holistic view of their payment data. Here’s how it can address the challenges associated with payment data analytics:

Unified Data Access: A provider agnostic portal provides a single point of access to payment data from various providers, eliminating data silos and simplifying data retrieval.

Streamlined Integration: It streamlines the integration process by abstracting the complexities of individual provider APIs, reducing the time and effort required for integration.

Flexibility and Choice: Businesses can work with multiple payment providers simultaneously or switch providers without extensive reintegration efforts, fostering flexibility and choice.

Enhanced Security: Provider agnostic portals often include robust security features to protect sensitive payment data, helping businesses maintain compliance with data protection regulations.

Customized Analytics: These portals typically offer customizable analytics and reporting tools, allowing businesses to tailor insights to their specific needs and goals.

Cost Efficiency: By optimizing payment data management and analytics, provider agnostic portals can lead to cost savings and improved operational efficiency.

Conclusion

Payment data analytics is a powerful tool for businesses seeking to gain a competitive edge and drive growth. However, the challenges associated with payment data management and integration can be overwhelming. A provider agnostic portal addresses these challenges by offering a unified, secure, and flexible platform for accessing payment data from multiple providers. By leveraging such a portal, businesses can unlock the full potential of payment data analytics, make informed decisions, and create a path toward continued success.